Payback Period Formula Excel Template for Several Investment Alternatives

Companies typically conduct a series of financial analysis before making any capital investments. Ideally, several projects are presented to the board, and executives are supported with a comprehensive project proposal. And one of the requirements in capital investments is that the payback period should be accurately calculated. This article will elaborate further on the concept of the payback method and payback period formula Excel Template.

The Payback Method

In the payback method, the project proposal that promises a quicker return of initial investment is desirable. The payback period refers to the time frame a project requires to recoup the amount invested. Management typically sets a maximum payback that is likely to be accepted by the company. Any project proposal shall exceed the desired payback period to be accepted; otherwise, it is rejected.

Say the company required new equipment and wanted to recover the cost of the equipment within five years. The decision to purchase the machine would be desirable if it promises a payback period of five years or less.

Payback Period Formula with Even Cash Flows

If an annual cash inflow is even or the same every period, the investment project's payback period can be calculated using this formula. This is most common for tenable real estate properties.

Payback Period = Required Investment / Net Annual Cash Inflow

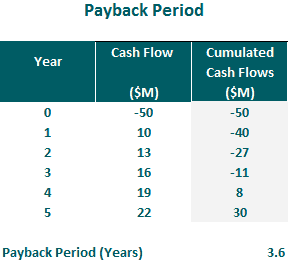

Payback Period Formula with Uneven Cash Flows

Most investment projects usually generate uneven cash flows, and the above formula will not work. When a project generates inconsistent cash inflows, we should calculate cumulative cash inflow and apply the following formula.

Payback Period = Years before full recovery + (Unrecovered Cost at the Start of the Year / Cash Flow during the Year)

Comparison of Two or More Alternatives

If the company has limited funds and several projects are lined up, the most beneficial for the company should be considered.

Example: If the company wants to reduce labor costs by investing in new equipment. There are two types of equipment available in the market, A & B. Equipment A cost $50,000 and reduces labor cost by $5000 while Equipment B cost $75,000 and reduces labor cost by $10,000. Which equipment would be accepted using the payback method?

Payback Period of Equipment A : $50,000 / $5,000 = 10 years

Payback Period of Equipment B: $75,000/ $10,000 = 7.5 years

Based on the payback period formula Excel Template, the equipment that is most beneficial for the company is Equipment B. Though, equipment A is cheaper, equipment B promises quicker investment returns and therefore, would be accepted.

Conclusion: The payback Period is the quickest way to determine if an investment proposal is desirable

If the company has several competing projects, the payback period is quite useful to quickly determine the project that would be accepted. But since this also has limitations, it is best to use a discounted payback method along with IRR and ROI.

Comments

Post a Comment