Payback Period in Excel for Capital Budgeting

Generally speaking, every capitalist wants to know the length of time required for their investment to be recovered. Nobody wants to hold their money in an investment where the rate and length of return are not desirable. This context will attempt to explain the payback period in excel in capital budgeting technique.

What is Capital Budgeting?

Capital budgeting is a process used to ascertain the worthiness of organization's long-term investments viewed quantitatively to give a rational basis for making a judgment. In simple terms, capital budgeting is a process of deciding whether or not the project would be accepted. Different investment opportunities are evaluated to obtain the highest possible return. Big companies typically use their own process in evaluating various projects in place. However, some practices should be used as gold standards in capital budgeting. This ensures a fair project evaluation and attempts to eliminate other factors and purely assess the project's stand-alone opportunity.

What is the Payback Period?

In capital budgeting, it refers to the time required for the return on investment to repay the original investment. This method is a simple way to evaluate the number of years required to return the investment. Ideally, most entities concentrate on projects with faster and more profitable payback. This method is used most often regardless of the field of endeavor because it is easy and understandable. There are no explicit criteria for decision-making except that the payback is than infinity.

Process of Calculating the Payback Period

Basically, there are lists of projects presented that define each project's initial investment and its anticipated annual cash flows. The assumption is that the project generates expected cash flows each year, from then the payback would be estimated reliably. More often than not, companies create more than one scenario by changing the initial investment to meet the appropriate risk level and other requirements.

Payback Period Formula

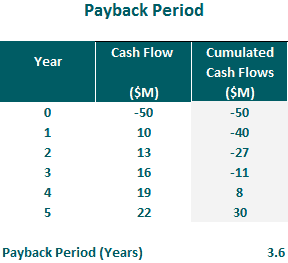

The payback period is typically expressed in years. The cash flows each year are accumulated until it reaches a positive number which will be the payback year. You can calculate a more exact payback period in excel using below formula.

Payback Period = Amount to be initially invested / Estimated Annual Net Cash Inflow.

Conclusion: Payback period is one of the most used metrics in capital budgeting

The payback period is often used because it is easy to apply and understand regardless of academic background and size. It is a useful measure of investment risk that is widely used when liquidity is an essential criterion.

Comments

Post a Comment