How to Create a Simple Personal Financial Plan Template

Personal Financial Plan is orderly management of personal finances created to maintain financial health, improve financial literacy, and achieve financial goals. Depending on your goals and volume of transactions, you may opt to track your funds on a ledger or an excel template.

Why do you need a Personal Financial Plan Template?

If you want to effectively manage your finances, increase your savings, or maybe plan for your future or kids’ future, then it is essential. A simple personal financial plan template will help you control your spending by organizing and amassing all information in one place. It is a useful tool that allows you to set your budget and manage your spending. We would agree that savings come after expenses for most of us, but it should be the other way around. However, due to various limitations and lack of discipline, it seems pretty impossible. Thus, if you want to change habitual spending, you need to start creating your financial plan immediately.

How to Create a Simple yet Effective Template?

1) Start now and start collating your bank account information. Begin with the current balances of your current and savings account as well as your credit cards.

2) Plot all the information, including auto-debit expenses, credit card cut-offs and payments, and the like.

3) Create an annual forecast of your expenses in the excel template. List all your expenses for home, health, living, and even seasonal expenses. Add additional columns for monthly expenses and prorate your budget.

4) In another sheet, create an annual forecast of your income. It should include salaries, interest from deposits, business income, bonuses, pension, and all other forms of income.

5) Export your monthly statement and categorize all inflows and outflows.

6) Generate your average monthly profit and loss summary based on actual and budgeted.

7) Reconcile the difference.

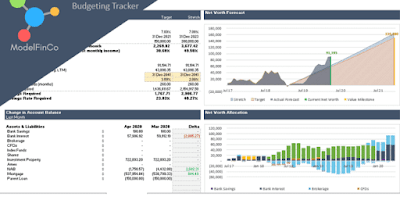

8) Create a dashboard where you could easily picture movements in your financials.

Financial plan templates may vary depending on your needs, goals, and transactions. But for a model to be effective, you have to implement it. If you want to plan for your retirement, then make it a habit to input all your transactions in a template. It would give you an overview of which part of your spending should you slash and put it into savings or investment instead. Besides, it would be nice to see an upward slope in your income rather than an upward slope in your expenses. This financial planning is more comfortable using a simple personal financial plan template that you could easily navigate and work efficiently.

Conclusion: Personal Financial Plan Template helps you plan your future

Personal Financial Planning is a decision. It’s a choice to achieve your financial goals. A useful personal financial template could help you save for your future by providing you an accurate report of your finances. This report and dashboard shall help you analyze variances that may occur and decide which part of your finances could be utilized for potential savings or investment.

If you want to effectively manage your finances, increase your savings, or maybe plan for your future or kids’ future, then it is essential. A simple personal financial plan template will help you control your spending by organizing and amassing all information in one place. It is a useful tool that allows you to set your budget and manage your spending. We would agree that savings come after expenses for most of us, but it should be the other way around. However, due to various limitations and lack of discipline, it seems pretty impossible. Thus, if you want to change habitual spending, you need to start creating your financial plan immediately.

How to Create a Simple yet Effective Template?

1) Start now and start collating your bank account information. Begin with the current balances of your current and savings account as well as your credit cards.

2) Plot all the information, including auto-debit expenses, credit card cut-offs and payments, and the like.

3) Create an annual forecast of your expenses in the excel template. List all your expenses for home, health, living, and even seasonal expenses. Add additional columns for monthly expenses and prorate your budget.

4) In another sheet, create an annual forecast of your income. It should include salaries, interest from deposits, business income, bonuses, pension, and all other forms of income.

5) Export your monthly statement and categorize all inflows and outflows.

6) Generate your average monthly profit and loss summary based on actual and budgeted.

7) Reconcile the difference.

8) Create a dashboard where you could easily picture movements in your financials.

Financial plan templates may vary depending on your needs, goals, and transactions. But for a model to be effective, you have to implement it. If you want to plan for your retirement, then make it a habit to input all your transactions in a template. It would give you an overview of which part of your spending should you slash and put it into savings or investment instead. Besides, it would be nice to see an upward slope in your income rather than an upward slope in your expenses. This financial planning is more comfortable using a simple personal financial plan template that you could easily navigate and work efficiently.

Conclusion: Personal Financial Plan Template helps you plan your future

Personal Financial Planning is a decision. It’s a choice to achieve your financial goals. A useful personal financial template could help you save for your future by providing you an accurate report of your finances. This report and dashboard shall help you analyze variances that may occur and decide which part of your finances could be utilized for potential savings or investment.

Comments

Post a Comment