IRR vs XIRR Functions in Excel – Which is better?

As you already know, the internal rate of return or IRR is a very helpful financial ratio used to evaluate the attractiveness of a business venture or a project. Many are dependent on this financial ratio that is why it is no wonder that MS Excel provided a function that allows the calculation of IRR by simply adding the IRR formula.

In Excel, you can find two IRR formulas to use which are the IRR formula and the XIRR formula (abbreviation for Extended Internal Rate of Return). Basically, the difference between the two is simply the following:

1. IRR Formula – used to calculate the Internal Rate of Return with the assumption that each cash flow event occur annually.

2. XIRR Formula – used to calculate the IRR with a series of cash flows that occur at irregular intervals defined by specific dates.

The syntax for how the formula for each function is written are also different which you can see and understand further in this article: IRR vs XIRR Formulas in Excel.

It is clear that comparing the two functions, the XIRR function offers a more accurate calculation of the IRR since it considers the timing of the cash flows. However, the only downside to it is that it requires more data and precision of input parameters such as the exact dates, otherwise, the accuracy of the resulting data is not reliable. As for the IRR function, it is very straightforward and easy to calculate. It also works best for generic calculations where the annual cash flow holds.

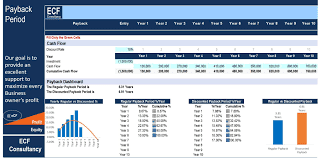

IRR vs XIRR, which function is better to use when calculating the IRR? You should be able to tell which one to use simply by determining the cash flows’ pattern. If you’re looking for financial model templates that includes the calculation and applies the IRR or XIRR functions, you can download here: IRR Financial Model Templates.

Comments

Post a Comment