How to Calculate the Discount Rate in DCF Analysis

To calculate the discount rate, one must first determine what the appropriate discount rate to use is. Many businesses tend to use their Weighted Average Cost of Capital or WACC if its risk report is similar to that of the business, otherwise, the other option would be to use the Capital Asset Pricing Model (CAPM) as the discount rate instead.

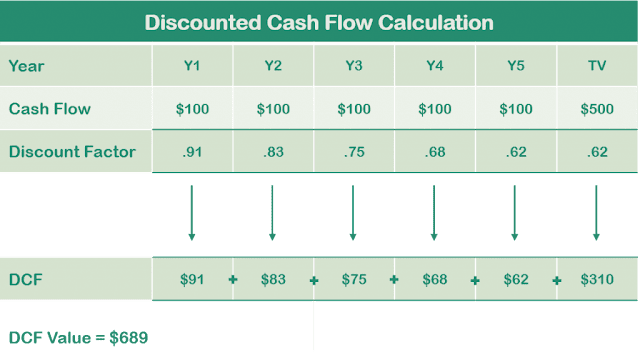

First things first, what is a discount rate and why is it considered when conducting a DCF analysis? DCF analysis is one of the approaches which uses the concept of the time value of money when valuing a project, company, and asset. To determine the present value of the future cash flows, the discount rate is then used. And as mentioned, the WACC is usually used as the discount rate but other rates are also considered depending on the business model such as using the required rate of return or the hurdle rate which investors expect to earn relative to the risk of the investment.

As you already know, the discount rate is often used to calculate the net present value of a business through DCF Analysis. However, it is also used for other purposes such as:

• Accounting the time value of money

• Accounting the risks of an investment

• Representing the opportunity cost for a firm

• Acting as the hurdle rate for investment decisions

• Turning different investments/ventures more comparable

If you want to learn more how to apply discount rate and how to calculate it in more detail, you can read more here: The Discount Rate in DCF Analysis. There will be example financial model templates which utilizes the calculation of the discount rate included so, feel free to download them to use as a reference. You can also check out other example financial models with different use cases at eFinancialModels, a platform which offers financial model templates that are specifically designed for different industries and other use cases by financial modeling experts.

First things first, what is a discount rate and why is it considered when conducting a DCF analysis? DCF analysis is one of the approaches which uses the concept of the time value of money when valuing a project, company, and asset. To determine the present value of the future cash flows, the discount rate is then used. And as mentioned, the WACC is usually used as the discount rate but other rates are also considered depending on the business model such as using the required rate of return or the hurdle rate which investors expect to earn relative to the risk of the investment.

As you already know, the discount rate is often used to calculate the net present value of a business through DCF Analysis. However, it is also used for other purposes such as:

• Accounting the time value of money

• Accounting the risks of an investment

• Representing the opportunity cost for a firm

• Acting as the hurdle rate for investment decisions

• Turning different investments/ventures more comparable

If you want to learn more how to apply discount rate and how to calculate it in more detail, you can read more here: The Discount Rate in DCF Analysis. There will be example financial model templates which utilizes the calculation of the discount rate included so, feel free to download them to use as a reference. You can also check out other example financial models with different use cases at eFinancialModels, a platform which offers financial model templates that are specifically designed for different industries and other use cases by financial modeling experts.

Comments

Post a Comment